The Evolution and Impact of Online Banking

The Rise of Online Banking

Online banking has become a cornerstone of modern finance, transforming the way individuals and businesses manage their money. From its humble beginnings as a niche service, it has evolved into a mainstream necessity, offering convenience and accessibility to millions worldwide. The rise of online banking can be traced back to the late 20th century when financial institutions began exploring digital solutions to enhance customer service. Initially, these services were limited to basic functions like balance inquiries and fund transfers. However, with the advent of the internet and advancements in technology, online banking has grown exponentially.

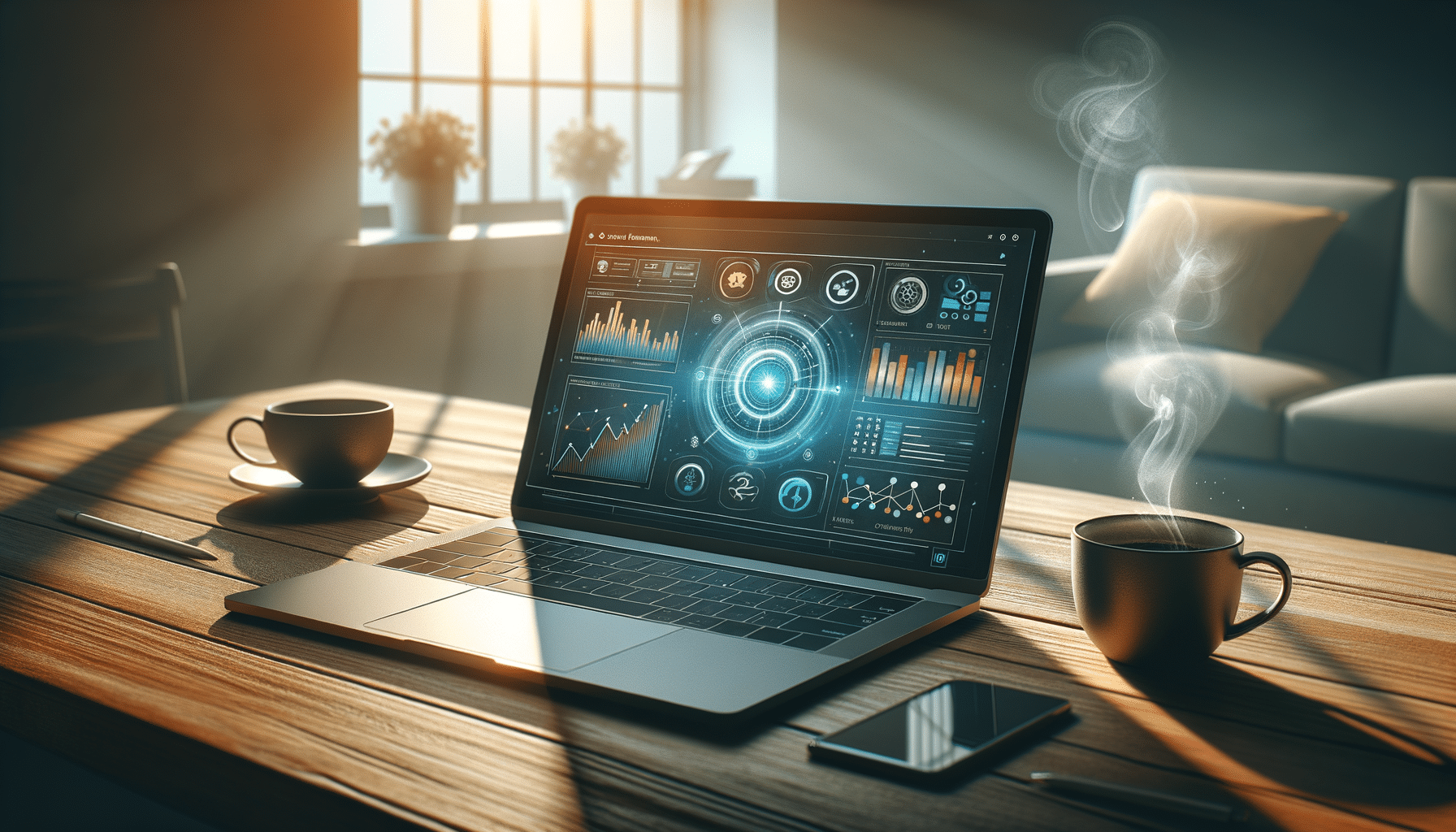

Today, online banking offers a wide array of services, including bill payments, loan applications, and investment management, all of which can be accessed from the comfort of one’s home or on-the-go. This evolution has been driven by the increasing demand for digital solutions and the need for banks to remain competitive in a fast-paced financial landscape. Moreover, the shift towards online banking has been accelerated by the global pandemic, which highlighted the importance of remote financial management. As a result, online banking has become an integral part of daily life, providing users with a seamless and efficient way to handle their financial affairs.

Advantages of Online Banking

Online banking offers numerous benefits that have contributed to its widespread adoption. One of the most significant advantages is convenience. Users can access their accounts 24/7, eliminating the need to visit a physical branch during business hours. This flexibility allows individuals to manage their finances at their own pace, whether it’s checking balances, transferring funds, or paying bills.

Another key benefit of online banking is the ability to easily track and manage transactions. With digital records and real-time updates, users can monitor their spending habits and make informed financial decisions. Additionally, many online banking platforms offer budgeting tools and alerts, helping users stay on top of their financial goals.

Security is also a major advantage, as banks employ advanced encryption and authentication measures to protect users’ sensitive information. While concerns about cyber threats remain, the continuous improvement of security protocols ensures that online banking is a safe and reliable option for managing finances.

- Round-the-clock access to accounts

- Real-time transaction monitoring

- Advanced security measures

- Convenient financial management tools

The Future of Online Banking

As technology continues to advance, the future of online banking looks promising. Financial institutions are investing heavily in digital innovation to enhance user experience and expand their service offerings. One of the emerging trends is the integration of artificial intelligence and machine learning, which can analyze user data to provide personalized financial advice and improve fraud detection.

Moreover, the rise of mobile banking apps has further revolutionized the way people interact with their banks. These apps offer a user-friendly interface and a wide range of features, from mobile deposits to peer-to-peer payments. As smartphones become more prevalent, mobile banking is expected to become even more popular, offering users unparalleled convenience and accessibility.

Another exciting development is the advent of blockchain technology, which has the potential to revolutionize online banking by providing secure, transparent, and efficient transactions. As these technologies continue to evolve, online banking will likely become more integrated into our daily lives, offering innovative solutions to meet the ever-changing needs of consumers.

In conclusion, the future of online banking is bright, with endless possibilities for innovation and growth. As financial institutions adapt to the digital age, users can expect to see even more benefits and conveniences in managing their finances online.

- Integration of AI and machine learning

- Expansion of mobile banking capabilities

- Potential of blockchain technology

- Continuous innovation and adaptation